For five decades, the Cherokee Generating Station, on the north side of Denver, ran on western Colorado coal and cheaply powered the population boom of Colorado’s Front Range. Its four coalfired, steam-electric generating units produced up to 717 megawatts, enough electricity for more than half a million homes. The plant—one of the largest operated by Xcel Energy in the state—also emitted many thousands of tons of pollutants annually, including nitrogen oxides, sulfur dioxides and carbon dioxide, contributing to poor air quality, smog and climate change. As for water, Cherokee was more innovative. The plant requires up to 10 million gallons or 30 acre feet per day to operate, but its water supply for years has been recycled wastewater from the same households purchasing its power.

Cherokee may embody the good, the bad and the ugly of energy development and power generation, but for the last two years, this cornerstone Colorado power facility has been undergoing a $530 million makeover to replace coal with more efficient natural gas. Xcel has already demolished Cherokee’s two oldest coal-fired units, and will shutter another by 2015. In their place, construction is now underway on a new 569-megawatt natural gas-fired, combined-cycle plant, which uses gas and steam turbines to run on fuel as well as waste heat that would otherwise be lost as exhaust. The last 352-megawatt coal-fired unit will be converted to run on natural gas by 2017.

The retrofit is the keystone of Colorado’s strategy to slash Front Range air pollution, including reducing smog-causing ozone levels by 86 percent. The 2010 Clean Air-Clean Jobs Act, signed into law by then-Governor Bill Ritter, serves as a roadmap to bring the state into compliance with federal air quality standards by phasing out older coal-fired power plants and replacing them with more efficient and less polluting gas-fired facilities and renewable energy. The law also helps Colorado prepare for anticipated federal greenhouse gas regulations to address climate change.

This shift is providing another important environmental advantage. “The retirement of coal plants and the movement toward natural gas is an important step [for addressing air pollution and carbon emissions], but the side effect is water use reduction,” says Kristen Averyt, director of the Western Water Assessment and associate director for science at the Cooperative Institute for Research in Environmental Sciences (CIRES) at University of Colorado Boulder. Planned nationwide retirements of coal plants, generating 51,000 megawatts, will eliminate 4 trillion gallons, or more than 12 million acre feet, in water withdrawals annually. That’s even after replacing them with more water-efficient power stations, according to a July 2013 report by the Union of Concerned Scientists. “[The reduced water use] is not intentional, but it’s a co-benefit, and I think that’s important to think about,” says Averyt.

With Colorado’s—and the nation’s—energy portfolio in transition, the intersection of water and energy is becoming less of an afterthought. From underground coal seams to sky-high wind currents, planners and policymakers are increasingly evaluating energy sources based on their water use and looking at how their choices can help address growth, climate change and other issues. And with its full menu of energy options, Colorado is “ground zero,” Averyt says, for testing the local impacts of national energy policies and influencing how the country powers its future.

Revamping the Energy Mix

Few states rival Colorado when it comes to energy resources. Impressive reserves of oil, gas and coal underlie parts of every corner of the state. Rivers and dams provide hydroelectricity on large and small scales. Uranium deposits in Paradox Valley and elsewhere could fuel nuclear plants. With 300 days of sunshine, solar energy potential abounds, and the eastern plains, where gusts can blow a lofty average of 20 miles per hour, are ideal for wind energy. Geothermal heat beneath the San Luis Valley and other areas holds energy potential too.

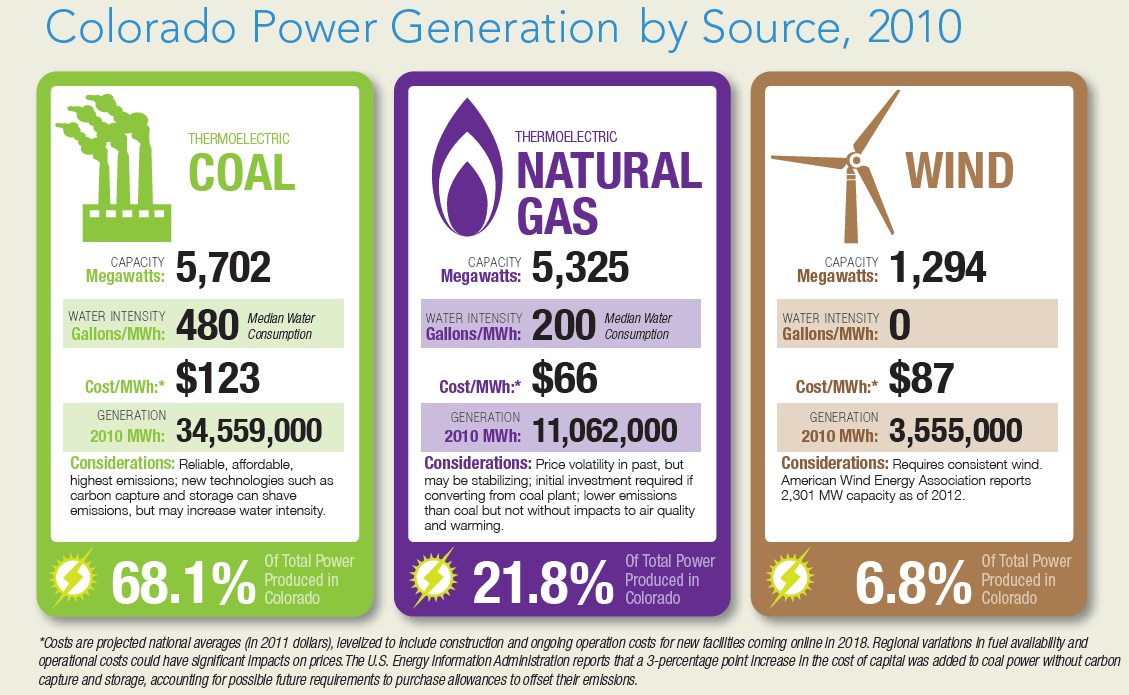

Colorado has relied on coal as its dominant power source since settlement due to local abundance, including wide-ranging deposits across the Western Slope, which makes it an especially affordable fuel. Coal powered more than 90 percent of the state’s net electricity generation as recently as 1995. Today, about half of U.S. electricity generation comes from coal, while Colorado relies on the fossil fuel for 67 percent of its power.

During the 1990s and early 2000s, as Colorado’s population swelled from 3.3 million to 5 million, federal air quality violations and concerns about pollutants from existing and new coal power kicked off a discussion on the state’s energy mix. In 2004, voters approved Amendment 37, establishing a renewable energy portfolio standard that mandated utilities tap renewable energy sources for 10 percent of their power by 2015.

Since Amendment 37 passed, the state legislature has revised the target renewable standard several times, most recently in June 2013. Now investor-owned utilities, of which Xcel is the largest in the state, are required to provide 30 percent of electricity from renewable sources by 2020, one of the highest benchmarks in the nation. Under the same timeline, city utilities must move to 10 percent renewables, and large rural electric cooperatives will have to reach 20 percent—a percentage doubled under the 2013 legislation. Many rural providers believe reaching that target in seven years is going to be incredibly difficult, if not impossible— in part due to the need for new transmission lines to connect renewable sources in their far-flung service areas.

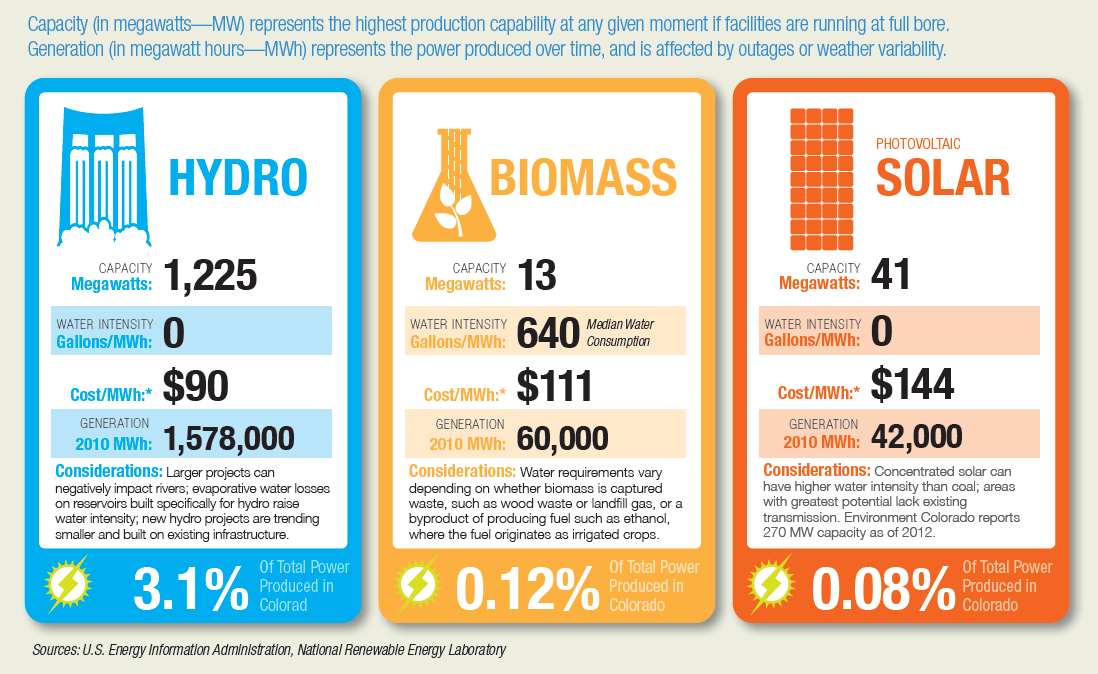

And yet, the statewide proliferation of photovoltaic solar panels and wind turbines is evidence of the change underway. Solar power systems now generate 270 megawatts of electricity in Colorado, although Environment Colorado and industry trade group Colorado Solar Energy Industries Association want to boost that total to 3,000 megawatts by 2030. So far, solar development has relied heavily on tax credits, exemptions and rebates from federal, state and local government and utilities in order to be price-competitive with coal or gas power. But installation costs for solar projects here have been decreasing, a promising sign of improving pricing equality with other energy sources.

Wind energy has developed even faster, with 2,300 installed megawatts of capacity as of late 2012. Ten years ago, Xcel supplied less than one percent of its electricity from wind energy, says Jack Ihle, the company’s director of environmental policy. Today, Xcel’s figure is 17 percent and growing, accounting for most of the state’s wind energy resources. As with solar, the federal renewable electricity production tax credit subsidizes wind, geothermal and biomass energy development to achieve competitive prices with fossil fuels. The increasing affordability and efficiency of wind turbines have also contributed to wind power prices nearing all-time lows in 2012, according to an August 2013 report by the U.S. Department of Energy’s Lawrence Berkeley National Laboratory.

Colorado’s utilities are meeting renewable goals, says Joshua Epel, chair of the state’s Public Utilities Commission. “No one else is doing anything else like Colorado, in terms of its renewable portfolio standard and Clean Air-Clean Jobs.” In addition to solar and wind development, Epel points to recent initiatives to capture and use methane from coal mines and to process and burn forest waste for bioenergy as promising test programs. “The strategies adopted have tremendous potential to propel Colorado forward,” Epel says.

While the Clean Air-Clean Jobs Act is spurring the reduction of coal power, the shift is also fueled by the natural gas boom. The advancement of horizontal drilling technology and hydraulic fracturing—used to obtain oil and gas from once-unobtainable deposits—have skyrocketed gas production around Colorado, the United States and the world.

The surge in hydraulic fracturing, or fracking, and gas drilling has lowered prices and made it a much more cost-effective fuel for power, Ihle says. Under Clean Air-Clean Jobs, Xcel plans to reduce its coal energy output from 69 to 45 percent of its total fuel mix by 2018, while ramping up gas energy from 17 to 35 percent. To pay for its Cherokee project, Xcel estimates rates for its customers will rise by just 2 percent.

Tri-State Generation and Transmission, a co-op which serves 44 smaller providers, says coal is still a more affordable fuel choice for its rural customers. Referencing a 2013 report by the American Coalition for Clean Coal Electricity, Tri-State’s water resources policy advisor Laura Chartrand says, “Striving for affordability is especially important to the 907,000 Colorado households earning less than $50,000 per year who devote an estimated 19 percent of their after-tax income to energy.”

Although nothing is currently slated for Colorado, nuclear power could factor into energy planning as a low-carbon source of electricity on par with the cost of power generation using other fuels. The Fort St. Vrain Generating Station in Weld County was Colorado’s only nuclear facility, but it was shut down in 1989 and is now operated by Xcel as a gas-fired plant. Few people support siting a nuclear plant near communities, based on fears of spills and meltdowns, and reactors are very costly to build. Nuclear power, including uranium processing and production, is also extremely water-intensive, requiring more water per megawatt-hour than fossil fuels. But technological breakthroughs, such as the use of treated sewage water at Arizona’s Palo Verde nuclear plant—the country’s largest nuclear facility—are already changing how planners and some members of the public view nuclear energy.

Even with the rush toward natural gas, the push for renewables, and potential carbon emissions regulations, Ihle says Xcel—and Colorado—aren’t likely to fully divest from coal. Xcel is upgrading pollution controls at several coal plants to further limit smog and air pollution and keep the plants running and in compliance with Clean Air Act regulations. “We see value in balance even as certain drivers like emissions regulations will cause us to look harder at cleaner resources,” Ihle says. “Coal has been a very cost-effective resource and price-stable for a long time, and we’ll look for ways to make it as clean as we can.”

The utility also supports developing carbon capture and storage technologies to produce fewer and less harmful emissions. Carbon capture has its own water use implications, however: According to Averyt, the technology presently requires twice as much water as coal power without carbon capture.

The Energy/Water Nexus

In the last decade, the nationwide economic recession has slowed Colorado’s population growth rate, while drought across the state has elevated the challenges facing utilities and resource managers. Looking ahead to 2040, state demographers and other planners forecast a more gradual 1.5 percent growth rate for Colorado. That’s still above the national average and equivalent to 80,000 or more new citizens each year who will want reliable and affordable electricity—and a beautiful place to live.

While improved air quality has driven energy policies, water conservation continues to get increasing attention from energy researchers and planners.

The “energy-water nexus” defines the mutual relationship between the two resources, with the acknowledgment that each affects the other’s availability. Water is essential to developing and generating energy, and energy is essential to supplying and treating drinking water and wastewater. In the western United States, water providers are among the largest users of electricity, while power plants require a significant quantity of water to operate.

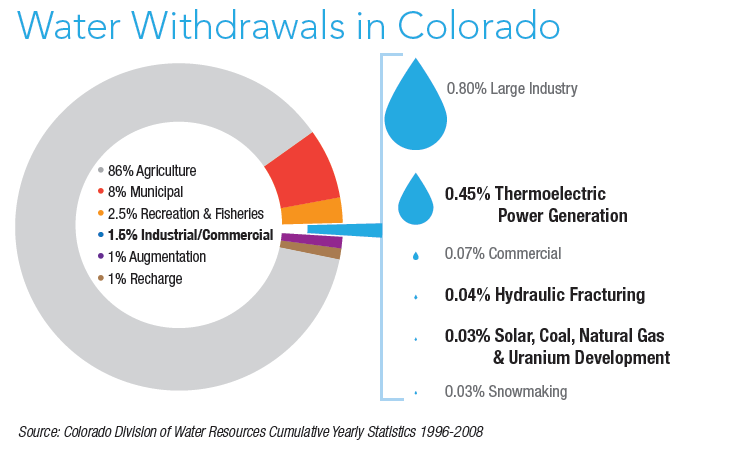

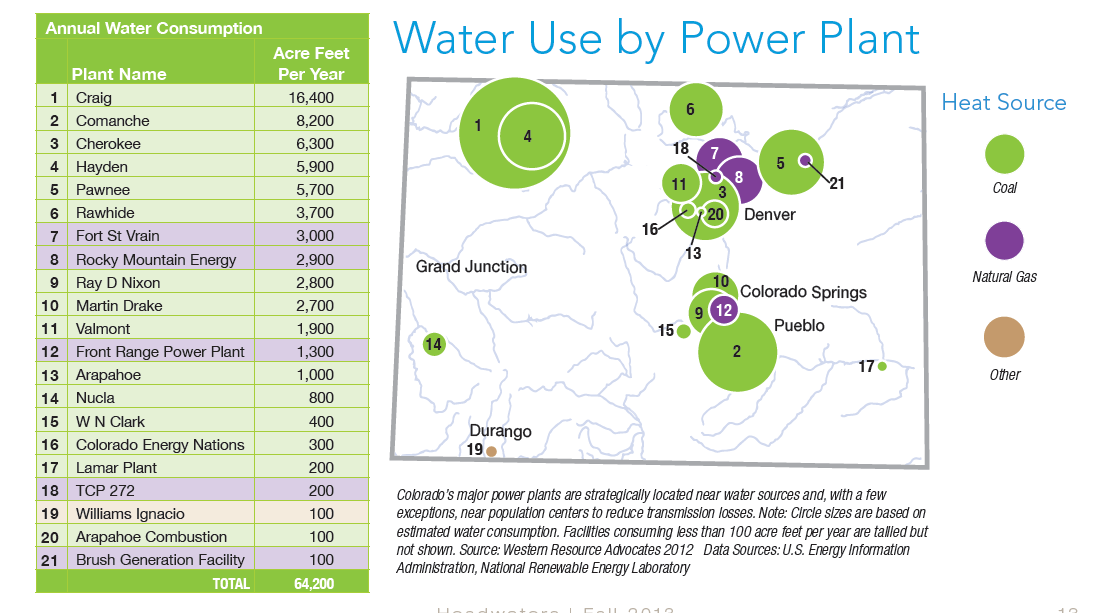

According to the Colorado Division of Water Resources, the state’s power plants withdraw 64,500 acre feet of water annually—and consume 90 percent of that. That’s enough water to meet the needs of more than 350,000 people, although in exchange, these plants generate more than 87 percent of the electricity used in Colorado.

Natural gas plants, which are replacing most of the lost coal-powered megawatts, use less water and are more efficient. Based on research from the National Renewable Energy Laboratory (NREL), a new coal plant consumes about 500 gallons per megawatt hour (MWh) produced, while a combined cycle gas plant consumes about 200 gallons per MWh. Combined cycle gas plants also convert 50 percent of energy to electricity, while the efficiency rate of coal stations is closer to 33 percent.

That’s not to say the process of obtaining natural gas through drilling and hydraulic fracturing doesn’t require its share of water, but according to Jordan Macknick, energy and environmental analyst for NREL, who has analyzed different power sources’ water consumption across their entire “life cycle,” the oil and gas industry’s water use is mostly “up front” during the extraction process, compared with coal power, which requires water continually for mining, transporting and processing over the life of the mine.

Jordan Macknick surrounds himself in solar research equipment at an NREL lab, where he studies the lifecycle water needs of different power sources. Photo By: Matthew Staver

Fracking’s water consumption has still been a major point of criticism from opponents. Depending on the depth and location of a well, an operator may use from 2 million to over 5 million gallons—1 million gallons is about 3 acre feet—of water to initially drill and frack a site, a volume significantly greater than that used for conventional drilling. The process also typically contaminates most of the water, rendering it unsuitable for future use, although more and more operations are testing and implementing treatment technologies that allow them to reuse and recycle water, which could provide benefits financially—and to surface flows and groundwater.

It’s all about tradeoffs, concludes Macknick. More gas-fired power will save water at the generation stations, but it does come with impacts on the ground at the shale plays where natural gas is extracted.

Water use also ranges across low-carbon and renewable energy sources. Wind power is unarguably the most “water-smart” alternative, consuming a relatively negligible amount for operations and little else for its “fuel” procurement or power production. Photovoltaic solar panels also use a minimal amount of water to make power, but manufacturing equipment requires some water. Concentrated solar power, which uses mirrors or lenses to beam sunlight to run a heat engine, usually a steam turbine, can require more water than coal plants to cool facilities, depending on the type of technology employed.

Low water-use cooling technologies at power plants also provide a way to conserve water. Dry cooling systems, for example, use air instead of water to cool the steam that passes through turbines, reducing a power facility’s water consumption by more than 90 percent compared with closed-loop, wet cooling processes. However, the technology has its tradeoffs: Dry cooling has higher capital costs than the alternatives and lower efficiency. A gasplant with a dry system may need to burn more fuel to produce the same amount of electricity as a facility with wet cooling, while a solar plant would be producing less power with a dry versus wet system.

“Low carbon isn’t always low water,” says Averyt, “but it can be depending on the choices you make.” Water conservation isn’t driving the rapid development of Colorado wind energy, but the savings are exactly the sort of unintentional byproduct that she identifies in energy policies.

Accounting for Water

Moments of energy-water nexus serendipity aside, planners and analysts now recognize that water management and drought planning should become a more integrated element of energy policy.

“Most of our clean energy policies have not been driven by water issues,” says Stacy Tellinghuisen, Western Resource Advocates senior energy/water policy analyst, “but I think as we see long-term drought affecting the Colorado River Basin and the region more broadly, we’re likely to see water issues become a bigger factor in shaping our energy policy in the future.”

The threat of drought and climate change impacts lingers over Colorado. Climate models project summer temperatures will warm 2.5 degrees Fahrenheit by 2025 and 4 degrees by 2050. While precipitation shifts are less certain, a report from the Western Water Assessment and the Colorado Water Conservation Board points to a reduced water supply in the state by 2050 and more severe and persistent drought conditions.

Colorado officials are working on a state water plan and climate action plan, both of which, leaders say, will address the linked relationship between energy and water. In the absence of national climate legislation, the state’s Clean Air-Clean Jobs Act also serves as preemptive action on climate change.

“Colorado is probably the leader in reducing greenhouse gas emissions on a per-capita basis,” says Epel, the Public Utilities Commission chairman.

“I think we’re on the right track, and Colorado is a leader in the region in terms of how they’re beginning to integrate water into energy decisions,” Tellinghuisen adds. But she says more is possible, such as managing energy supplies to be more resilient to drought.

Analysts, including Averyt and Macknick, working with Union of Concerned Scientists recently compiled a report, “Water-Smart Power,” highlighting risks and opportunities facing energy and water providers. Among the report’s conclusions: Our current strategy of replacing coal with natural gas as the dominant power source will reduce water withdrawals for power by more than 80 percent and water consumption for power by more than 40 percent—but much of those savings won’t occur until after 2030 because of rising demands from population growth and the continued use of fossil fuels over the next few decades.

Regarding climate, replacing coal-fired power with natural gas production has already contributed to lower carbon emissions from electricity generation, according to data from the U.S. Energy Information Administration (EIA). The Environmental Protection Agency figures gas-fired electricity emits only 40 percent of equivalent carbon dioxide compared with coal, even accounting for methane leakage and other factors. But despite the efficiency gains and water savings associated with gas-fired power, computer models performed by the “Water-Smart Power” report’s authors and data from the EIA suggest using gas to supply 60 percent of U.S. power needs would minimally reduce the power sector’s carbon emissions in the long-term, especially as energy demands grow.

While there remains cause for concern, there is also reason for hope. Xcel and other utilities now consider the environment along with reliability and affordability in making decisions. Goals for renewable and alternative energy production are being met in Colorado. And even if energy policies don’t yet directly incorporate water planning here, the nexus is never far off in people’s minds.

“In the West, water is always a fundamental part of the equation in every decision that is made,” says Averyt. “It’s built into our thinking.”

Print

Print